What is Your Firm's Financial Trend?

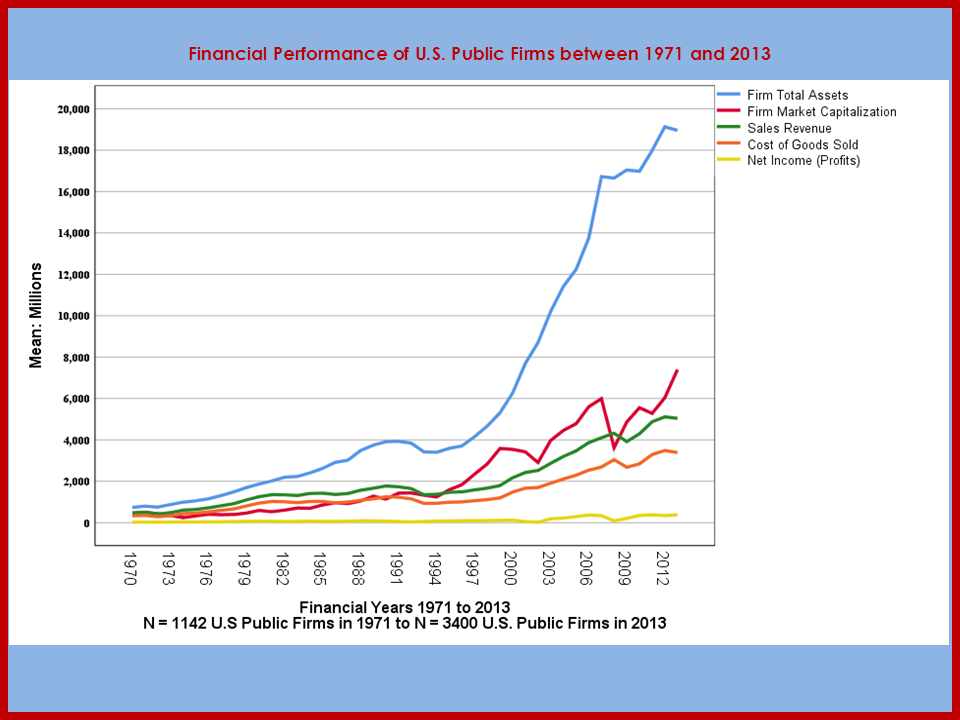

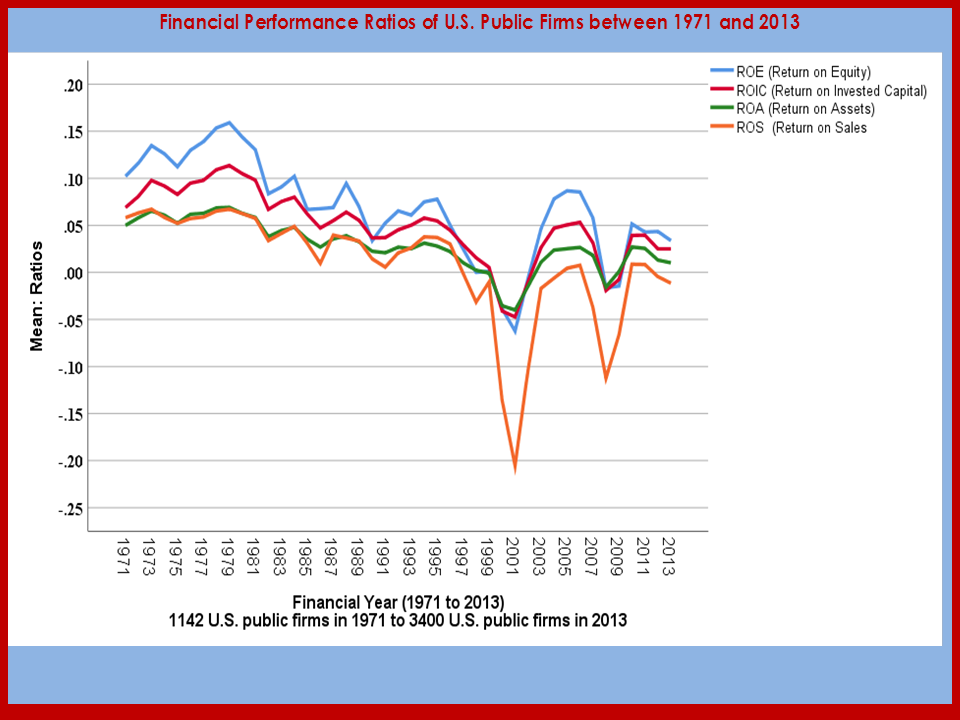

Where does your Firm stand in comparison with U.S. public firms?

How does your firm's history of yearly financial and performance ratios look like?

Where these numbers are heading for your firm?

How do we explain the declining trend in terms of Profitability Ratios?

Why there is a disconnect between Firms Assets, Sales Revenue, Market Capitalization and Profits?

Above graphs based on the data of U.S. Public companies from 1970 to 2013. From 1142 firms in 1971 to 3400 firms in 2013 were examined and the averages for each financial year plotted.

Can you speculate on the reasons for this trend?

Several factors can be juxtaposed as rationale for the trend.

1) Global competition!

2) Volatile industry life cycles! Disruptive new technologies!

3) Volatile financial markets! Short-termism?

4) Rise of bureaucratic complexity!

5) Dynamic markets looking for something new always!

6) Has the industry environment become entropic causing randomness and volatility?

How is your company doing? How are you weathering the disruptive industry storms? Is your firm geared for the change? New Strategies?

Your Opinions are Welcome!